Tax Connect

madhuvridhi

Tag: income tax

-

Budget 2026: Direct Tax “Ease of Living” Provisions – Lower TDS/TCS, Simplified Compliance, and Dispute Resolution

TCS rate reduction 2026, TDS on manpower supply, MACT interest tax exemption, Foreign Asset Disclosure Scheme 2026, Revised Return deadline March 31, Lower deduction certificate automation.

-

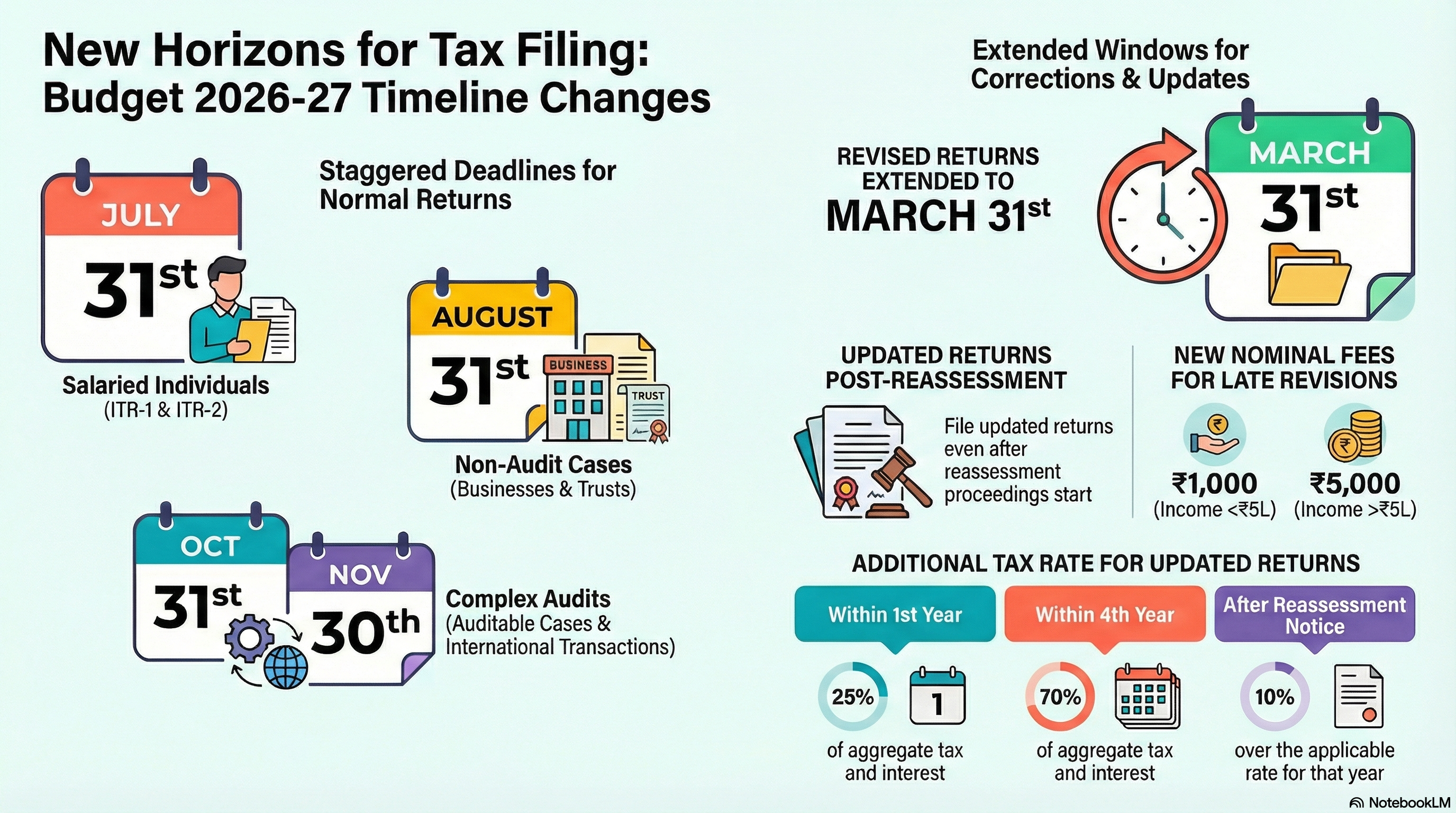

Budget 2026: Major Changes in Income Tax Return Deadlines – Normal, Belated, and Updated Returns

Budget 2026 extends ITR deadlines: 31st Aug for non-audit businesses and 31st Mar for Revised/Belated returns. Updated returns now allowed during reassessment.

-

Mumbai ITAT Decision: Tax Authorities Must Accept Declared Profits if Books Not Rejected

This ruling serves as a vital precedent for taxpayers facing ex-parte assessments. It reinforces that tax authorities cannot disregard audited financial statements without valid grounds for rejection. Additionally, it highlights the importance of analyzing the actual date of property transactions rather than relying solely on the date of TDS payments when determining the correct assessment…

-

Claim house rent allowance (HRA) income tax

Know more about the importance of landlord’s PAN for your rent HRA tax exemption claim and what are the new compliance requirements for rent HRA

-

Income Tax & FEMA NRI Compliance in India

In line with regulatory guidance and to ensure compliance under Indian laws, we bring to your attention certain key compliance requirements under the Foreign Exchange Management (FEMA) Act, 1999 and the Income Tax Act, 1961, that may apply to you as an NRI. Here is what you can do: 1. Update your Tax Residency Status

-

Major Income Tax Amendments applicable from 1st April 2025

Here are the major changes in income tax which will be effective from 1st April, 2025 i.e. from FY 2025-26

-

Cash Spending

Income tax on cash spending: These expenses will be considered as income and accordingly taxed if incurred in cash

-

Is Alimony received Taxable ??

Each alimony case is distinct and personal to the case at hand. Regardless of this fact, alimony is a financial transaction and like all financial transactions are required to stand the scrutiny of income tax liability. So, do the beneficiaries receiving alimony need to pay income tax on it? The answer to this is tricky.

-

Cost of Real Estate bought before 2001 – Capital Gain Calculation – Budget 2024

I-T dept clarifies acquisition cost of real estate bought before 2001 for LTCG calculations